Real Estate Taxes

Pay Your Real Estate Tax Bill Online!

- Beginning December 7, 2011 we switched our online pay vendor to Interware Development Company based out of Amherst, New Hampshire.

- We are able to accept Credit Card payments and Automatic Clearing House (ACH) payments for real estate taxes online and the counter in the Clerk's Office using Visa, Mastercard, American Express or Discover.

Click below to pay your property taxes online:

The TAX YEAR runs from April 1st to March 31st; we bill semi-annually.

The first issue bill is an estimated bill, based on the previous year's tax rate, usually half of the previous year's total unless there have been improvements made as of April 1st.

The second issue bill is mailed after the NH Department of Revenue sets the town's tax rate for the current year; you are then billed for the remainder of the tax year, less what you paid on your first issue bill.

2023 FIRST ISSUE BILLS WERE MAILED ON: 7/3/2023

- FIRST ISSUE BILLS ARE DUE ON: 7/3/2023

- Interest on unpaid balances begin to accumulate at the rate of 8% APR after 7/3/2023

2023 SECOND ISSUE BILLS WERE MAILED ON: 12/28/2023

- SECOND ISSUE BILLS ARE DUE ON: 12/28/2023

- Second issue bills are issued after the NH Department of Revenue sets the tax rate for the current year to determine what the new tax rate will be

- Interest on unpaid balances begin to accumulate at the rate of 8% APR on 12/28/2023

The 2021 Tax Lien will be executed on May 4, 2023 for unpaid 2022 property taxes, yield taxes and current use taxes. The last day to accept personal checks for the Impending Tax Lien will April 20, 2023.

Tax Deeding for the 2021 Tax Lien (2020 tax levy) and older will take place on June 22, 2023. The last day to accept personal checks for an impending tax deed is June 8, 2023.

CLICK HERE TO CHANGE YOUR MAILING ADDRESS

We accept pre-payments of property taxes for up to two years in advance.

Payment Options:

- USPS - mail your tax payments, postmark dates for interest are accepted. Checks should be made payable to "Town of Gilmanton"

- Payments can be made using an electronic check (ACH) from a checking or savings account for a minimal fee. ($2.50)

- Credit Cards incur a 2.99% convenience fee on the total amount of the bill.

Starting on April 1st, 2023, our citizen-sponsored fees will be adjusted as follows:

Online transaction fees: $1.75 per item (previously $1.50)

Credit card processing fees: 2.99% (previously 2.79%)

Minimum credit card fee & flat ACH fees: $2.50

E-Check payments: $1.50 per payment

*Please note that all real estate tax payments need to be made first to the oldest delinquent real estate taxes (tax lien), if any, for the indicated property. Please contact us if you should have any questions by phone: (603) 267-6726 or email.

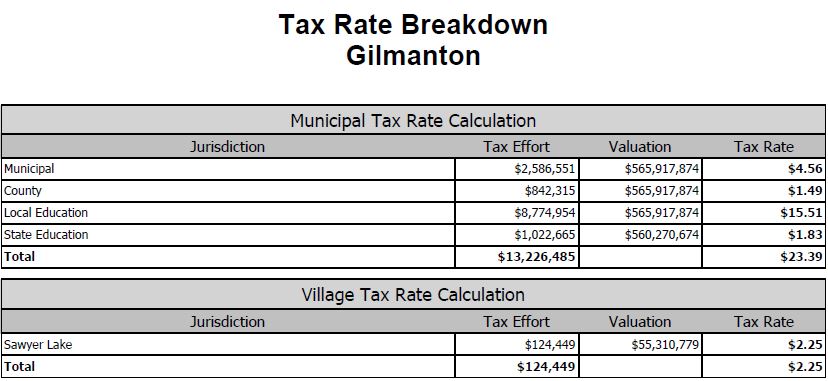

| 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

Town | 4.56 | 5.17 | 5.58 | 5.61 | 5.58 | 5.83 | 4.82 | 4.23 | 5.51 | 4.10 | 4.97 |

Local School | 15.51 | 16.35 | 15.09 | 14.64 | 14.22 | 15.95 | 16.57 | 16.15 | 16.73 | 14.82 | 12.36 |

State Education | 1.83 | 1.32 | 1.81 | 1.82 | 1.85 | 2.18 | 2.20 | 2.33 | 2.34 | 2.67 | 2.43 |

County | 1.49 | 1.13 | 1.02 | 1.13 | 1.14 | 1.38 | 1.21 | 1.21 | 1.36 | 1.34 | 1.39 |

Total | 23.39 | 23.97 | 23.50 | 23.20 | 22.79 | 25.34 | 24.80 | 23.91 | 25.94 | 22.93 | 21.15 |

Village District | - | - | - | - | - | - | - | - | - | - | - |

Sawyer Lake District | 2.25 | 1.99 | 2.36 | 1.78 | 1.79 | 2.22 | 2.00 | 1.90 | 2.04 | 1.97 | 1.81 |

| Equalized Ratio | 59.3% | 61.6% | 76.3% | 91.2% | 99.0% | 92.6% | 94.4% | 97.0% | 103.9% | 102% | 111.3% |